(Spotlight Delaware is a community-powered, collaborative, nonprofit newsroom covering the First State. Learn more at spotlightdelaware.org).

This week, state legislators will begin the final markup of the state’s Fiscal Year 2026 budget.

Delaware’s fiscal years run July 1 to June 30, and therefore require the General Assembly to approve a state budget before they leave Dover each June.

For the last five years, Delaware has enjoyed increasing revenues and significant post-COVID federal investments, but that will begin to change, according to the latest projections from the state’s fiscal analysts. Next year’s revenues are now projected to increase just 1.1% — far below the state’s pace of spending.

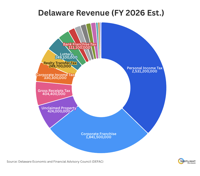

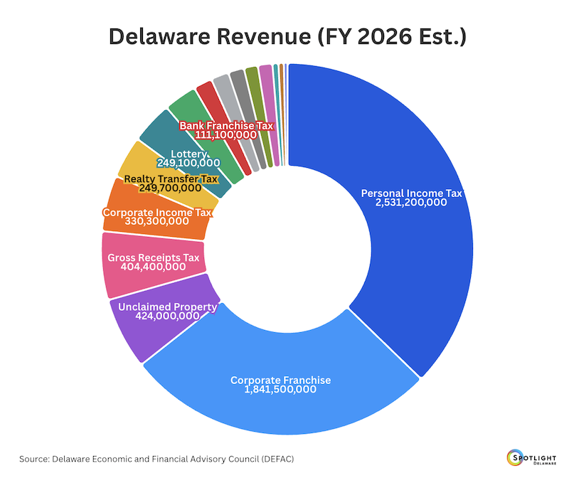

With that in mind, we wanted to give residents a breakdown of the state’s revenues as more difficult decisions around state spending will be coming. All figures are based on projections for FY 2026 as of May 19.

Personal income tax: $2.5 billion

By far the largest source of revenue for Delaware is its collection of personal income tax, which is estimated to total $2.531 billion next year after refunds. This is the tax paid by all employers and workers on wages earned, which has a top line tax of 6.6% on income of $60,000 or more annually.

This year has seen significant debate around whether to create higher income brackets, and potentially lowering the burden on lower wage earners.

Corporate franchise: $1.8 billion

The second largest source of revenue is Delaware’s leading corporate franchise industry, which incorporates companies, tracks their required filings and gives companies access to the Court of Chancery.

Following the passage of Senate Bill 21 this year that made significant changes to the legal framework around the corporate franchise and drew debate as to whether it benefited the wealthiest business leaders in the nation, some legislators say it is time to rely less on the corporate franchise work.

Before refunds, corporations here pay an annual tax that totals about $1.33 billion while filings around limited liability companies (LLCs) and limited partnerships (LPs) totals $522.6 million.

Unclaimed Property: $424 million

Because of Delaware’s preeminence in the corporate franchise, the state also received a disproportionately large cut of unclaimed property. This includes everything from long-forgotten checking and savings accounts, uncashed wage and payroll checks, uncashed stock dividends, stock certificates, insurance payments, utility deposits, customer deposits, accounts payable, credit balances, refund checks, money orders, traveler’s checks, mineral proceeds, court deposits, uncashed death benefit checks, unused gift cards, and life insurance proceeds.

You can even search for benefits to you that may have been unpaid.

Like the corporate franchise, unclaimed property is similarly under threat from neighboring states that argue Delaware law preempts cash that should flow back to them. A Supreme Court case ended in a settlement that lost MoneyGram products for Delaware’s coffers.

Gross Receipts Tax: $404 million

Delaware is famous for not having a sales tax, but most small business owners would be quick to note that the state does quietly tax sales.

While the state does not charge a tax to consumers at the point of sale, it does charge a tax on a percentage of a business’ sales. The taxes range from about 0.09 cents to 0.74 cents on the dollar, depending on the business activity.

Corporate Income Tax: $303 million

All companies that have actual operations in Delaware also pay a corporate income tax. That is a rate set at 8.7% of federal taxable income allocated and apportioned to Delaware based on an equally weighted three-factor method of apportionment. The factors are property, wages and sales in Delaware as a ratio of property, wages and sales everywhere.

Realty Transfer Tax: $249.7 million

Any time real estate is sold in Delaware, the sale price is subject to a 2.5% state realty transfer tax. (Another 1.5% goes to the local jurisdiction.) That cut to the state has been rising since the pandemic as Delaware’s housing market has boomed.

Lottery: $249.1 million

Between the states casinos, sports betting, scratch-off cards, its share of multi-state drawings, and other sources, gambling brings in almost $250 million annually for Delaware.

Business Entity Fees / UCC: $197 million

Businesses that are incorporated in Delaware pay fees to file paperwork regarding their board’s actions. Uniform Commercial Code, or UCC, filings to notify lenders of actions also carry a fee.

Cigarette Tax: $82.4 million

The state’s cigarette tax rate is currently $2.10 for a standard pack of 20 cigarettes. This tax is paid by the cigarette wholesalers (affixing agents) and passed on to the consumer. Delaware also has a 30% tax on un-stamped tobacco products like cigars and snuff and, in 2018, adding a new tax on vape fluid.

Other revenues: $484.3 million

A variety of other smaller taxes and fees on banks, insurance, hospitals, public utilities and alcoholic beverages add to state coffers. Also contributing more than $100 million is dividends and interest collected by the state’s investment portfolio.

(0) comments

Welcome to the discussion.

Log In

Keep it Clean. Please avoid obscene, vulgar, lewd, racist or sexually-oriented language.

PLEASE TURN OFF YOUR CAPS LOCK.

Don't Threaten. Threats of harming another person will not be tolerated.

Be Truthful. Don't knowingly lie about anyone or anything.

Be Nice. No racism, sexism or any sort of -ism that is degrading to another person.

Be Proactive. Use the 'Report' link on each comment to let us know of abusive posts.

Share with Us. We'd love to hear eyewitness accounts, the history behind an article.